Sign up for our newsletter!

Your data will be handled in compliance with our privacy policy.

Your data will be handled in compliance with our privacy policy.

While traditional development processes often progress at a measured pace, truly disruptive technologies, such as Smoltek’s Porous Transport Electrode (PTE), can dramatically compress timelines. When faced with potentially market-changing innovations, industrial enterprises must choose between maintaining the status quo, slow internal development, or embracing partnership with innovative companies like Smoltek Hydrogen.

Thomas Barregren • April 22, 2025

When Clayton Christensen introduced the concept of disruptive innovation in 1995, he described how smaller companies with fewer resources could successfully challenge established industry leaders. Today, this concept has evolved far beyond a theoretical framework – it now shapes corporate strategy across industries, especially when deciding how to respond to potentially game-changing technologies like Smoltek Hydrogen’s Porous Transport Electrode (PTE).

The business landscape has changed dramatically since Christensen developed his theory 30 years ago. Back then, large industrial enterprises like Volvo, SKF, Ericsson, and Intel set the pace for product development with methodical, often multi-year cycles. Today, companies like Apple, NVIDIA, and even hydrogen specialists like PowerCell demonstrate how faster, more agile approaches to innovation can capture markets in a fraction of the time.

This acceleration has been driven partly by competitive pressure and partly by industrial enterprises adapting their strategies to identify, evaluate, and adopt breakthrough technologies more rapidly. Many have developed specialized units dedicated to tracking emerging innovations and recommending swift action when they encounter truly disruptive potential.

Disruptive innovation isn’t just about building a better product. It’s about fundamentally changing the economics of a market in a way that creates new opportunities or eliminates long-standing constraints. This distinction is crucial for understanding why some technologies trigger rapid adoption while others progress through traditional development timelines.

Smoltek Hydrogen’s Porous Transport Electrode (PTE) technology represents a textbook case of disruptive innovation, fundamentally changing the economics and possibilities of hydrogen production.

The challenge facing the hydrogen industry is not merely technical but structural: PEM electrolyzers (which convert renewable electricity into hydrogen) require iridium as a catalyst. This ultra-rare metal is 2–3 times more expensive than gold, with global production limited to just 7–8 tons annually, mostly as a byproduct from mines in South Africa and Zimbabwe.

At current technology levels requiring 2 mg of iridium per square centimeter, the limited global supply available after accounting for other industrial needs (like electronics and chemical catalysts) can support only 4–5 gigawatts of PEM electrolyzer capacity annually. This is less than 1% of the 560 GW the IEA’s Net Zero scenario requires by 2030 to meet climate goals. This severe supply bottleneck creates a significant cost problem: catalyst costs alone account for approximately $60 million per gigawatt of production capacity.

Smoltek’s breakthrough tackles this problem at its root. Instead of coating the membrane with ink containing iridium of which most never comes into contact with the water, we grow carbon nanofibers directly onto the porous transport layers, through which water flows, creating a structure with 30 times more surface area. We then precisely place iridium atoms on this expanded surface, ensuring that nearly every atom participates in the reaction – achieving full performance at just 0.1 mg/cm², a 95% reduction that solves both cost and supply constraints.

The impact is transformative in two ways:

What makes this innovation particularly disruptive is that despite decades of research by major industrial players, no one has managed to reduce iridium loading below 0.5 mg/cm² while maintaining performance in real-world applications – these loadings remain five times higher than Smoltek’s breakthrough 0.1 mg/cm², which works beyond laboratory conditions.

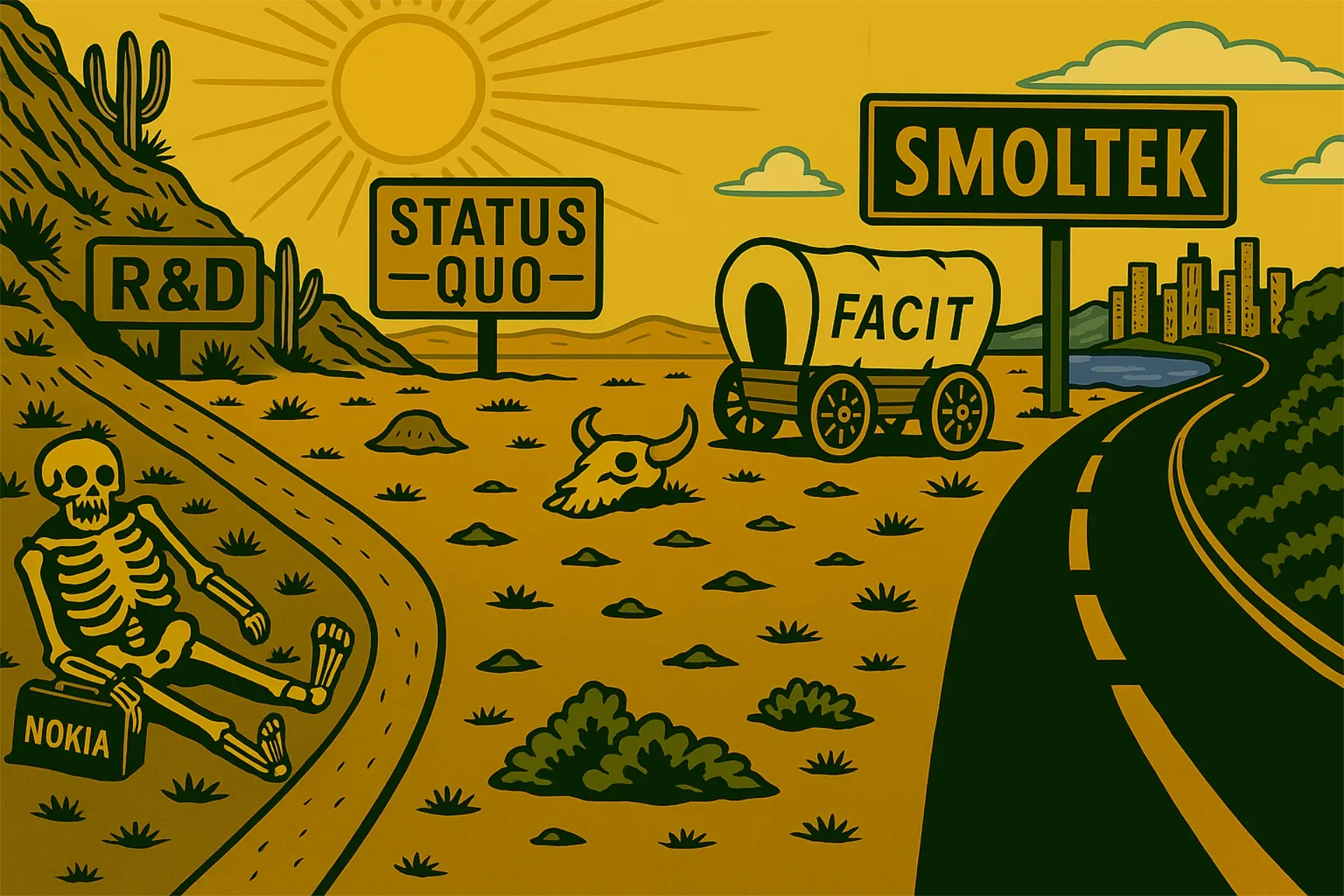

When confronted with potentially disruptive technologies like Smoltek’s PTE, industrial enterprises face a critical strategic decision point. History shows they typically choose one of three paths, each with dramatically different outcomes:

Some companies believe their established position is secure enough to weather technological shifts. This often proves to be a fatal miscalculation.

Consider Facit, the Swedish manufacturer that dominated the mechanical calculator market in the 1960s. When electronic calculators emerged, Facit’s leadership dismissed them as too limited compared to their precision mechanical devices. By 1973, the company was essentially bankrupt, outcompeted by electronics that quickly became both cheaper and more capable.

Similarly, Kodak – despite actually inventing the first digital camera in 1975 – clung to its profitable film business rather than aggressively pursuing digital photography. The result? A 130-year-old industry giant filed for bankruptcy in 2012, while companies that embraced digital imaging flourished.

Blockbuster faced the same fate by dismissing Netflix’s streaming model until it was too late, stubbornly maintaining its store-based rental approach even as consumer behavior rapidly shifted toward digital consumption.

Other companies recognize the threat but choose to develop competing technology in-house, often underestimating the time required to catch up to specialized innovators.

Nokia saw the smartphone revolution coming but spent years trying to modernize its Symbian operating system rather than quickly adopting Android. By the time they finally embraced Windows Phone, the market had moved on, and their dominant position had evaporated.

BlackBerry made a similar misstep, investing years developing BlackBerry 10 when they could have leveraged Android much earlier. The delay proved fatal to their smartphone business.

Perhaps most famously, Xerox developed many revolutionary technologies at its PARC research center – including the graphical user interface and mouse – but failed to commercialize them quickly. This gave companies like Apple the opportunity to refine these innovations and bring them to market first.

The most successful industrial enterprises recognize when it’s faster and more efficient to partner with or acquire innovative technologies rather than developing them internally.

Google’s acquisition of Android in 2005 gave them a foundation to build a mobile ecosystem that now powers billions of devices worldwide. Meanwhile, Nokia and BlackBerry wasted years on internal development before eventually losing almost their entire market share.

Assa Abloy transformed itself from a traditional mechanical lock manufacturer into a global leader in digital access solutions through strategic acquisitions of companies like HID Global. Instead of spending a decade developing competing digital technologies internally, they integrated existing innovations and rapidly scaled them through their global distribution network.

John Deere similarly recognized that developing AI-based precision agriculture technology in-house would take years they couldn’t afford to lose. By acquiring Blue River Technology, they immediately gained cutting-edge capabilities that now give them significant advantages over competitors still developing similar systems.

The hydrogen industry faces a clear strategic need for iridium reduction. For PEM electrolyzer manufacturers, Smoltek’s technology provides exactly the kind of opportunity that creates the three-choice scenario described above.

Companies can either:

The stakes are particularly high because the window for establishing leadership in the green hydrogen market is now. With governments worldwide committing hundreds of billions to hydrogen infrastructure development, companies that can scale production fastest will secure dominant positions for decades to come.

When industrial enterprises recognize truly disruptive potential, they don’t abandon their structured development process described in a previous article – they accelerate it. The six stages we described in the article remain the same, but companies move through them much faster when faced with a breakthrough like Smoltek’s PTE technology.

This acceleration happens because the typical questions that slow each stage become easier to answer:

This accelerated progression through the same structured stages explains why forward-thinking companies, like Heraeus and Impact Coatings move quickly to establish strategic partnerships with innovators like Smoltek. They recognize that while the development process remains the same, the timeline can compress dramatically with truly disruptive technologies.

Several hydrogen industry players exemplify how leveraging external innovation through partnerships and acquisitions accelerates progress:

What these examples illustrate is the power of the ‘Option 3’ strategy in the rapidly evolving hydrogen sector. By strategically partnering with or acquiring specialized innovators like PowerCell and Hydrogenics, or specific assets like those from Ballard, established players like Bosch, SFC Energy, and Cummins can drastically shorten development cycles and accelerate market entry. In a market driven by the urgent need for decarbonization and enabled by technological breakthroughs, leveraging external innovation becomes a key accelerator for companies aiming to lead.

The path forward for PEM electrolyzer manufacturers mirrors historical turning points. Continuing with iridium-heavy technology risks obsolescence, like Facit facing electronic calculators. Attempting slow internal development risks missing the crucial market window, like Nokia confronting the smartphone revolution. The alternative – the proven path to thriving – involves embracing breakthrough external innovation. Smoltek’s PTE technology offers exactly that: the critical, verified solution needed to overcome the iridium bottleneck and compete effectively in the burgeoning hydrogen economy.

Given the dramatic cost reductions ($60M down to $3M per GW) and the 20× scaling potential unlocked by Smoltek Hydrogen’s disruptive PTE technology, the strategic and economic logic for manufacturers to partner with Smoltek Hydrogen becomes overwhelming. In this context, delaying adoption or pursuing less effective internal R&D appears increasingly untenable. We expect this clear value proposition to drive significant industrial engagement.

The industrial logic outlined here points towards significant interest in Smoltek’s solution. For our investors, this means being part of bringing a vital technology to life. We are working hard to build the right partnerships to deliver PTE to the market, and we believe your backing is crucial as we aim to make a real impact on the hydrogen economy and the wider energy transition.

Your data will be handled in compliance with our privacy policy.